25+ Debt to equity calculator

The cost of the external equity is equal to the current total equity minus the targeted equity. Credit card debt.

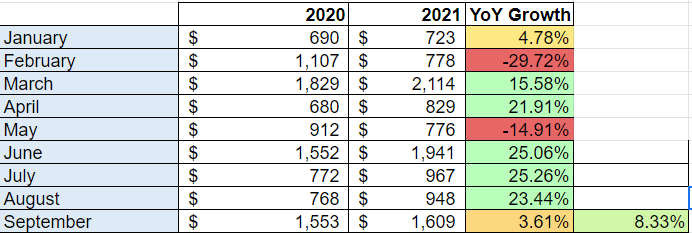

My Dividend Growth Portfolio Q3 Update 30 Holdings 11 Buys And 2 Sells Seeking Alpha

According to the Federal Reserve the average credit card.

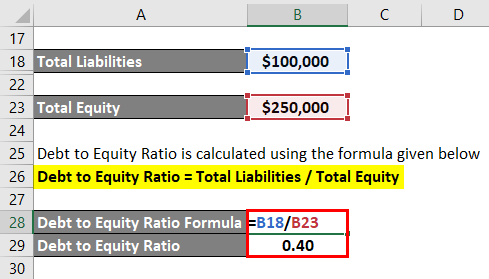

. So the debt to equity of Youth Company is 025. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or. DebtEquity DE Ratio calculated by dividing a companys total liabilities by its stockholders equity is a debt ratio used to measure a companys financial.

Ad Use LendingTrees Marketplace To Find The Best Home Equity Loan Option For You. The debt-to-equity ratio is. Using a home equity product to pay off a high-interest credit card could save you quite a bit of interest.

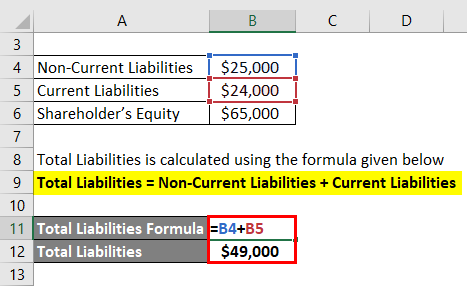

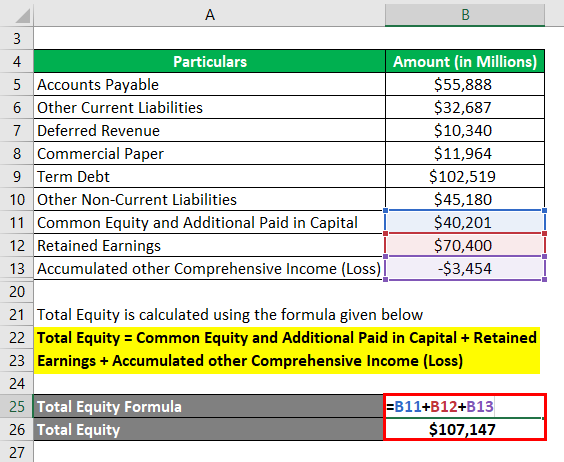

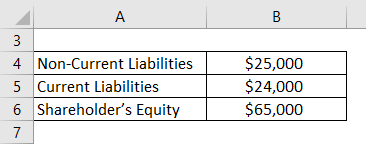

This calculator will find solutions for up to three measures of the debt of a business or organization - debt ratio debt equity ratio and times interest earned ratio. It is a measure of. To use this online calculator for Debt to Equity Ratio enter Total Liabilities TL Total Shareholders Equity TSE and hit the calculate button.

A high debt to equity ratio is considered anything over 15 which may indicate that the company is experiencing financial difficulties. Here is how the Debt to Equity Ratio. Find the following items on your.

Firstly calculate the total liabilities of the company by summing up all the liabilities which is. This is an online debt to equity ratio calculatorThe debt-to-equity ratio DE is a financial ratio indicating the relative proportion of shareholders equity and debt used to finance a companys. Debt to Equity Ratio in Practice.

What is a Debt-to-Income Ratio. Simply enter in the companys total debt and total equity and click on the calculate button to. The formula for debt to equity ratio can be derived by using the following steps.

This number may be much higher in some industries as. The Debt to Equity Ratio Calculator calculates the debt to equity ratio of a company instantly. The Debt to Equity Ratio or Indebtedness as it is often known is a financial metric that indicates the relative proportion of liabilities and shareholder equity in the company.

Debt equity ratio Total liabilities Total shareholders equity 160000 640000 ¼ 025. Dont Settle For Just One Offer Compare Home Equity Rates And Find Your Lowest Instantly. A high debt to equity ratio is considered anything over 15 which may indicate that the company is experiencing financial difficulties.

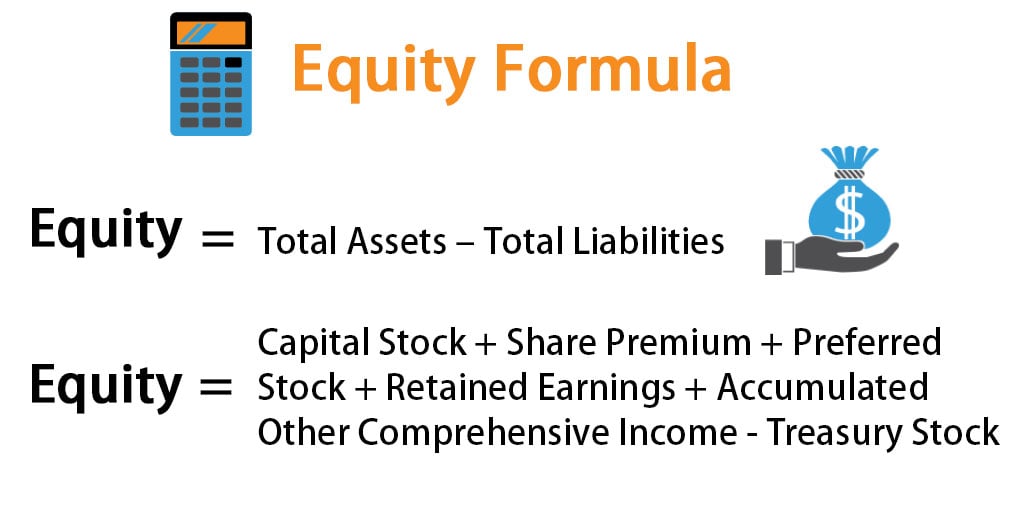

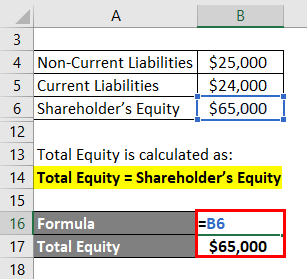

In a normal situation a ratio of 21 is. If a company is trying to seek 11 million in equity then subtract 1 million from. Stockholders equity this indicator is determined by subtracting liabilities from the total of a companys assets and represents the companys book value.

Gather the most recent statement for each debt - such as credit cards car and boat loans and home equity loans - you want to include in your payment plan.

Debt To Equity Ratio Formula Calculator Examples With Excel Template

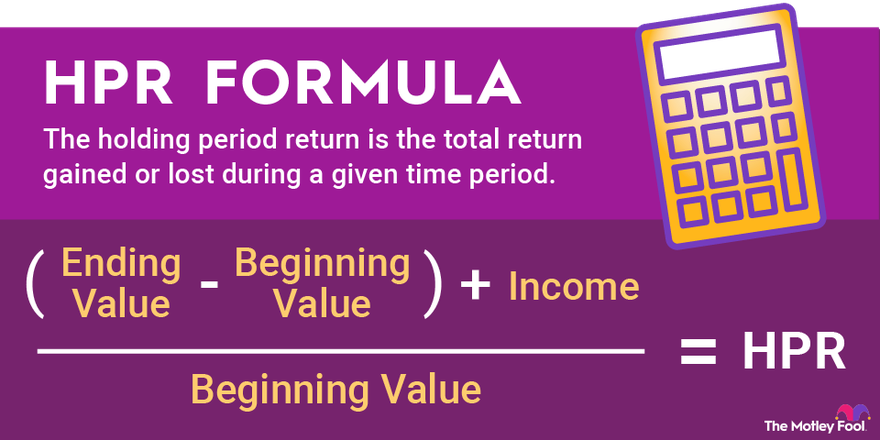

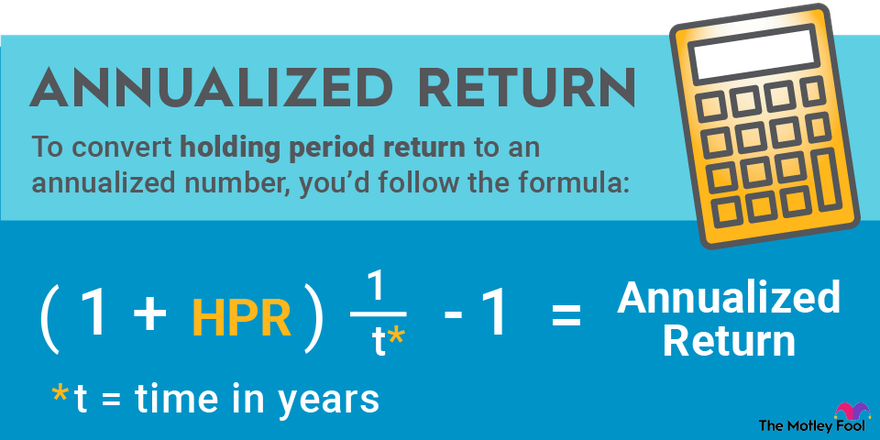

How To Calculate Holding Period Return

Debt To Equity Ratio Formula Calculator Examples With Excel Template

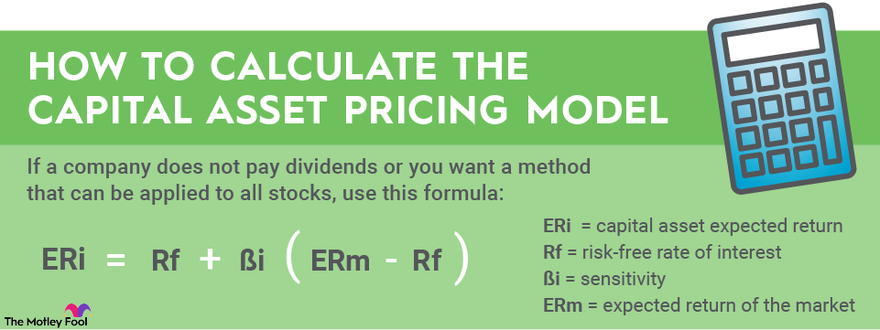

Weighted Average Cost Of Capital Formula

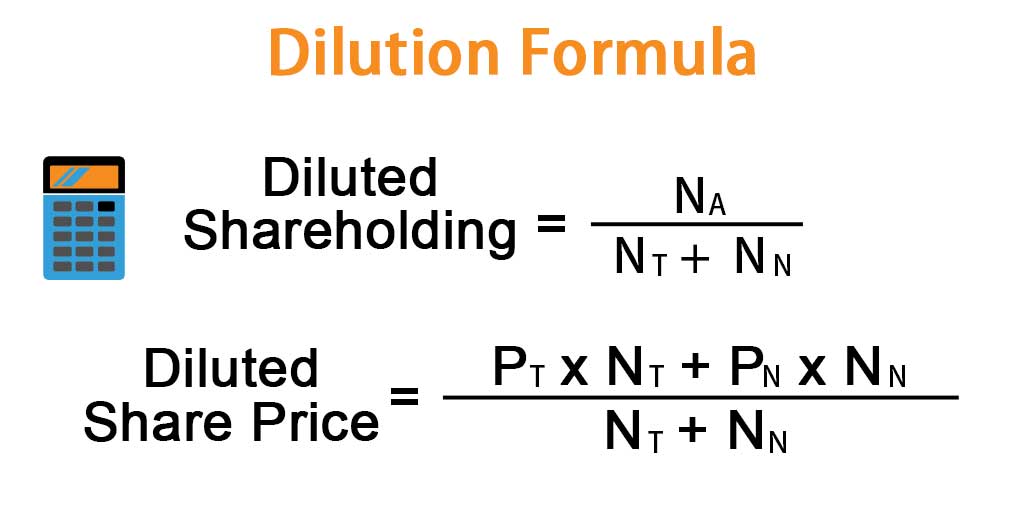

Dilution Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Rent Vs Buy Calculator The Devil S In The Details Toronto Realty Blog

Equity Formula Calculator Examples With Excel Template

How To Calculate Holding Period Return

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Nice Write Properly Your Accomplishments In College Application Resume

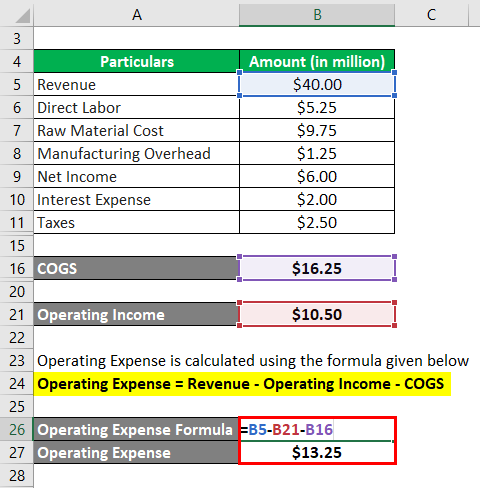

Operating Expense Formula Calculator Examples With Excel Template

Weighted Average Cost Of Capital Formula

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Calculating Diluted Earnings Per Share

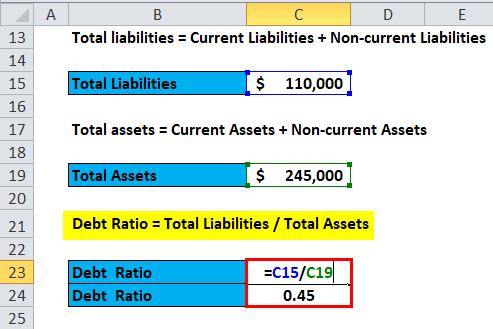

Debt Ratio Formula Calculator With Excel Template